Four Views on Navigating to the ‘New Normal’

I sat down with four people involved in their companies’ efforts to move through the COVID-19 pandemic. They’re four Centrical customers involved in the financial services arena. As the five of us spoke, another 70 or so listened in. They were attendees to a webinar Centrical held recently on “Navigating to the ‘New Normal.” The aim was to get a sense of how companies are adapting in the crisis and realigning their businesses to be well-positioned once the pandemic is past.

My expectation was to hear tales of woe. Instead, the four customers spoke of resilience, innovation, and compassion. They were:

- Caroline Hollingshead, Knowledge Management Specialist, PEMCO Insurance

- Erin Trout, AVP, Business Analyst Supervisor, Huntington Bank

- Chris Spitler, Senior Director, Engagement & Experience Design, TIAA

- Becky Burke, Vice President, BankWest

It’s my view that the path to the “new normal” moves through three stages:

- Stage 1 – Set up the infrastructure to support the new (work from home) environment;

- Stage 2 – Engage employees in ways the reduce isolation and anxiety so they’re able to be productive in their new surroundings; and,

- Stage 3 – Realign and reskill so performance and productivity can return to pre-crisis service levels.

We looked at all three stages plus peeked around the corner, so to speak, to get a sense of what these companies are planning to do next. Here’s a summary of our discussion.

Stage 1 – Technology Transformation

In an odd coincidence, TIAA’s Spitler shared that his team decided – about a year prior to the COVID-19 outbreak – to conduct a pilot to examine a virtual contact center operation. They worked through the regulations, identified the right people to be part of the test, and had everything lined up, ready to go when – BAM – the health crisis hit.

Instead of looking at getting a group of 15 customer service personnel involved in a test, he was challenged to get more than 700 employees set up and able to serve clients. Spitler noted the “scale is enormous” to do something like that quickly and correctly. In a bit more than a week, the 700 were situated and performing as they had before COVID-19. In fact, from an operational standpoint, Spitler said, “there was no degradation in performance.”

Huntington’s Trout was part of a group that orchestrated the shift of 600 of 800 service reps operating in four contact centers to their homes. That effort involved the sourcing and supply of laptop computers to those employees as all used desktops in the centers. Trout observed they were not about to have the agents drive back to the centers and load the desktops into their cars for set up back at their homes. Along with the laptops, headsets, and soft phones compatible with their software had to distributed.

One quarter of them opted to remain working from the contact centers. Because a far smaller number of employees were on site, social distancing could be managed effectively. Whether it was an at-home or on-site service rep, Trout observed that after four weeks of operating in crisis mode, service scores were at record highs. She said, it was a testimony to the “resilience of the employees.”

Stage 2 – Employee Transition

The first stage was largely about hard assets and software solutions. This stage is all about people, who, unlike computers, programs and soft phones, have emotions. BankWest’s Burke shared that the bank’s management wanted to be strong and clear in communicating there would be no layoffs or furloughs. She said that served to “reduce stress.” In addition, a new PTO code was established for COVID-19-related matters. For example, “if parents needed time off to help their kids with remote learning, that code was to be used.” The message from management was, “your jobs are safe and we’re going take care of you beyond that.”

Burke commented that communications went in all directions at the bank; top-down, bottom-up, within and across teams and, most definitely peer-to-peer. A COVID-19 Task Force could be contacted at any time to answer all questions or concerns. Burke said she made daily check-in calls to everyone on her team. Business matters as well as personal ones were touched on. It was about being human.

Interestingly, BankWest has 330 employees spread out across South Dakota. Burke offered the view that much of the staff was already accustomed to reaching out to one another virtually. She said, “it’s not uncommon to work with someone who’s 200 miles away.” Even still, every employee made a point of keeping the communications going. And it wasn’t just phone chats. The bank used Centrical to help employees learn how to work from home, put schedules in place, and remain healthy.

The building of a stronger framework for superb teamwork became evident to Burke. She said, “the staff felt more connected and was doing really good work.” In addition, she underscored the benefit of management offering guidance and a real give-and-take with respect to closed-loop feedback.

Hollingshead said members and their supervisors of PEMCO’s customer support teams held video conferences every morning. This ensured everyone was on the same page and little concerns could be addressed before they became big issues. Management held weekly call-ins, offered company updates monthly, and, periodically, shared updates on insurance industry and COVID-19 issues.

She noted that the economic crisis created by the pandemic caused several customers to tell us they couldn’t pay premiums. We offered a 15% credit on auto policies, in part because most people were driving far less than before the health crisis hit. In parallel, PEMCO offered its employees a “Spruce Up Your Home Office” bonus. The aim was to provide funds to buy a better chair or desk lamp; to make working from home more enjoyable and productive. Combined with the credit to policy holders, this bonus sent the message to employees the company was strong, and anxiety could be taken down a few notches.

Stage 3 – Align, Reskill to Perform

In the throes of a crisis, the obvious aim is to get through it and, if possible, reach pre-crisis performance levels. In the case of Huntington Bank, Trout said they “changed the way we manage.” She added, “we made big use of themed videos” to aid alignment but, more importantly, to “recognize employee efforts creatively.” Employees who saw their names and faces in videos highlighting those who went above and beyond was highly motivating.

In fairness, Trout added, folks in the contact centers don’t always feel what they do is recognized. While the videos had a big impact, a message directed to a contact center staffer from an executive on the leadership team made a bigger impact. Doing simple things that say “you’re important to this company and your efforts are appreciative” has an amazing effect.

“We used Centrical to offer courses to employees on how best to operate in a remote work environment,” Burke said. They then mixed in some fun with the training. A “guess whose home office this is photo contest” served to make the training real, spur some healthy competition, and bring smiles to all involved in the process. Centrical was also used to deliver shout-outs that boosted spirits and helped to get everyone focused and moving together.

While Burke acknowledged that a move to revise goals has not yet been decided upon, the overall BankWest team is pushing ahead, driving toward the goals established before COVID-19. She noted those were being attained or exceeded although restricted branch operations may adjust those targets..

What’s Next in the ‘New Normal”

Trout and Burke both pointed to the effect of the Small Business Administration (SBA) lending program set up soon after we were told to “shelter in place.” Both financial institutions needed to reskill employees who were never involved in lending to help with the tsunami of loan applications. In each case, employees pulled together to get the job done. They felt this approach will carry on – to work in unison to support the customer. This suggests shifting roles and responsibilities – as it has occurred during the health crisis – may continue in the “new normal,” meaning the rapidly deployed upskilling seen during the pandemic could continue.

Hollingshead pointed out the insurance industry, in which PEMCO competes, is one where decisions are largely driven by regulations. The crisis has forced the regulatory bodies to move faster. “As a result, we’re updating our processes, she noted. In a number of ways, the company’s business model is undergoing some change. For example, before COVID-19, food delivery was not covered under its auto policies. But, as she observed, “behaviors are changing, we need to be more flexible. In effect, we got the coverage exclusion excluded because lots of people are trying to make some money delivery pizzas and other foods. We’re seeing what changes need to be made and then we’re going about changing them.”

Spitler believes we will see change accelerate. In particular, “we’re looking at a different employee; one who is fine not working in an office, not limited to a 9 to 5 shift.’ He added, “I see us moving toward a location agnostic posture where exceptional customer service can be provided from anyplace.” He feels it “may not happen tomorrow but it will happen.” Post-pandemic, he suggests, the companies that will be well-positioned to succeed are the ones able to move faster.

Taken together, these comments suggest to me that the management mantra of “faster, better, cheaper,” may become, in the post-pandemic days ahead “smarter, faster, better…together.”

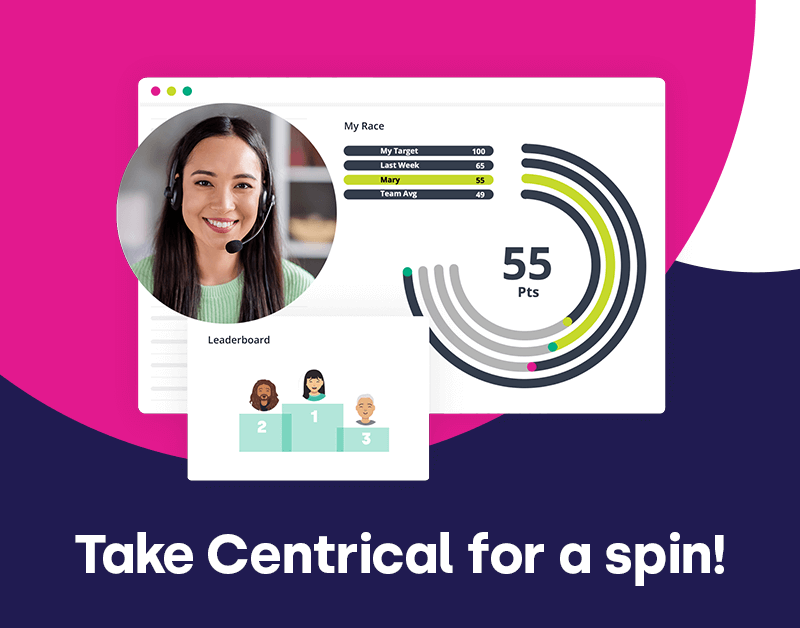

Engage and motivate your frontline teams

Improve performance with an AI-powered digital coach

Deliver world class CX with dynamic, actionable quality evaluations

Boost performance with personalized, actionable goals

Nurture employee success with the power of AI

Listen and respond to your frontline, continuously

Drive productivity with performance-driven learning that sticks

Drive agent efficiency, deliver client results

Keep tech teams motivated and proficient on products and services while exceeding targets

Maintain compliance while building customer happiness and loyalty

Enlighten energy teams to boost engagement

Engage, develop, and retain your agents while driving better CX

Improve the employee experience for your reservations and service desk agents

Dalit Sadeh

Dalit Sadeh April Crichlow

April Crichlow Ella Davidson

Ella Davidson Linat Mart

Linat Mart Gal Rimon

Gal Rimon Jayme Smithers

Jayme Smithers Doron Neumann

Doron Neumann Daphne Saragosti

Daphne Saragosti Ronen Botzer

Ronen Botzer Ariel Herman

Ariel Herman