Understanding Finance Call Centers: A Comprehensive 2024 Guide

The financial sector is estimated to make up 20- 25% of the world economy. According to one set of stats, in the U.S. alone, the finance and insurance industry adds $2 trillion to the GDP, and accounts for a total of 7.4% of the total GDP. The financial services vertical isn’t just relegated to retail banks, wealth management, and similar services – the sector also includes insurance, fintech, and other industries, with approximately 539,447 private establishments and over 1,000 government establishments.

Most companies in this area interact with their customers via the finance call center. It, therefore, makes sense that with so much at stake, the finance call center is optimized to deliver on the promises and potential of the finance industry. In this article, we’ll speak to a few basics around finance call centers, their functions, the role of technology in finance call centers, their evolution, and some solutions for finance call centers.

What is a Financial Call Center?

A financial call center is comprised of frontline teams that handle inbound and outbound calls with customers and potential customers of financial institutions.

Call centers differ widely, depending on the finance call center type, the company, and the part of the industry. The finance call center is a very specific case and differs from other call centers, with its own challenges and opportunities.

For example, cross-skilling is critical in a finance call center. Finance call center associates are expected to be educated about how to address different types of inquiries, as well as constantly-changing rules and regulations. When interacting with customers, agents must remain compliant, while also being empathetic and building customer satisfaction and loyalty.

Key Functions of a Finance Call Center

What are the key functions of a finance call center? These functions include:

Customer Support This includes addressing customer needs related to financial products and services. Finance call center agents answer questions about bank accounts, credit cards, loans, investments, or any other financial offering.

Account Management Related to customer support, account management for finance call centers more specifically deals with areas including account updates, balance inquiries, transaction disputes, and account closures.

Payment Assistance From making payments to requesting extensions or setting up a payment plan, many finance call centers will deal with these types of sensitive transactions.

Security (including fraud prevention) Finance call centers play a central role in fraud prevention and security. They monitor and identify potentially fraudulent activities, such as unauthorized transactions or suspicious account behavior, and call center agents are often trained to detect and report fraudulent incidents, guide customers on security best practices, and assist in resolving fraud-related issues.

Financial Guidance and Advice A finance call center can offer financial guidance and advice to customers, within certain parameters and subject to specific laws and regulations. This can include general information on financial planning, budgeting, and saving strategies, or more specific information on particular products.

Technical Support Like almost every other industry today, many customers in the finance industry are interacting with companies through websites or apps. Technical support is therefore a critical part of any finance call center operation.

Perhaps the most important function of a finance call center is to give customers a great experience. Getting this right is where the magic of CX (customer experience) and EX (employee experience) come together – in other words, by empowering and engaging your finance call center agents, you’re likely to see many more satisfied customers.

One of the easiest and most effective ways of achieving this is by using technology that’s purpose-built for finance call centers.

The Role of Technology in Finance Call Centers

With the volume of calls that finance call centers have to deal with, and the potential that technology has to identify weaknesses and opportunities in the finance call center environment, it makes sense that technology has a central role to play in running an effective finance call center.

Some key areas in which technology is improving the effectiveness and efficiency of finance call centers include:

Call monitoring and analytics This technology can capture and analyze multiple data points from calls. From more technical elements such as wait times and call durations, to value-adding analytics around sentiment, trends, and common issues. It can also be used for finance call center agent feedback and training.

Compliance and security The financial industry is heavily regulated, with call center inquiries being a major part of this. Technology can assist financial call centers tremendously, for example when it comes to authentication, encryption, and security.

Cross-channel integration Today’s finance call centers are not only about voice communication; interactions with customers can take place on web-based chat, mobile-based messaging channels, and multiple other platforms.

While these are examples of how technology impacts the technical elements of finance call center interactions, it’s the impact technology can have on the call center agents themselves where the effect is really felt.

How Finance Call Centers Enhance Customer Experience

Finance call centers can enhance the customer experience in a number of ways. Of course, there are the “low-hanging fruit” such as reducing wait times or providing effective self-service options that allow customers to transact or get answers to their questions quickly.

However, it’s by investing in their frontline teams that financial services companies can really make the biggest impact.

By providing timely, pro-active coaching and feedback, enabling ongoing learning, making data come alive, and gamifying the experience for finance call center associates, organizations can ensure the highest level of compliance while building customer happiness and loyalty.

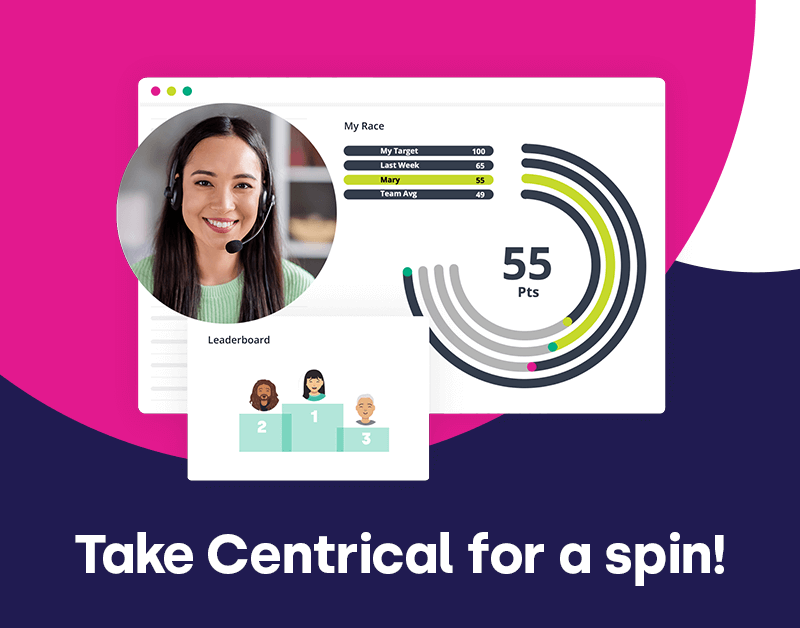

See the Centrical Platform in action with a quick preview.

Future Trends: The Evolution of Finance Call Centers

The finance call center is evolving. Some of the exciting trends in the industry include:

- Latest gamification platforms being used to reduce attrition, increase motivation, and boost engagement

- Moving rapidly from being viewed as a cost center, to becoming a profit center

- Seeing finance call center agents as brand ambassadors

- AI assisting agents by increasing personalization, satisfying customers, and providing ongoing value

- Cloud-based software supporting decentralized and distributed workforces

These trends – and many others – are reshaping the finance call center industry.

Centrical Call Center Solutions for the Finance Sector

Centrical’s finance call center solution is already used by some of the world’s biggest players in the space to dramatically improve both the employee and customer experience.

Centrical offers the following unmatched features and benefits:

Actionable, Dynamic KPIs Leverage performance data to offer real-time performance visibility for your employees, making KPIs actionable and employees motivated to achieve their goals.

Targeted Microlearning By continuously educating employees and providing personalized and targeted microlearning, finance call centers can mitigate risk, while maximizing upselling and cross-selling opportunities – and get an edge over competitors.

Augmented Coaching Coaching and feedback mechanisms build stronger bonds between managers and associates and help boost performance and engagement while reducing attrition. AI-powered coaching insights take these capabilities to a whole new level.

AI-powered content creation With the sheer amount of frontline training materials needed for finance call centers (including training around compliance updates) it can be tough for admins to create the needed materials in a timely manner. The Centrical platform’s AI Microlearning capability enables admins to quickly create learning materials at scale.

Quality Management Tools Quality assurance is a big part of the finance call center agent experience. But this process has largely been disconnected, inconsistent, and static, has lacked a feedback loop, and is overall not conducive to optimizing potential value. The Centrical platform’s quality assurance capability enables organizations improve processes with customized forms, providing personalized feedback, and identifying coaching and learning opportunities in the flow of work.

Full Suite of Engagement Tools With Centrical’s gamified approach, employees can earn points, level up, participate in team competitions and dynamic leaderboards, earn milestone badges, and more.

With Centrical, clients experience a 20% increase in resolution rates, 30% lower early attrition, and a 10% average increase in CSAT scores.

For a personalized demo of how Centrical can help you smash your KPIs, click here.

Summary: Finance Call Centers can Drive Business Success

In this article, we saw how finance call centers can be optimized to become key drivers of business success when leveraged correctly. Below are a few key takeaways:

- Finance call centers have unique requirements for agents, including continuous cross-skilling, upskilling, and staying current on new products of regulatory changes

- The finance call center experience is evolving for both employees and customers, largely thanks to technology and a focus on the employee experience

- By investing in the frontline employee experience, finance call centers will enhance and elevate the customer experience, improving KPIs such as CSAT

- Advanced gamification and incorporating AI, can provide personalized coaching and interactive KPI progress achievement, offer easy-to-digest microlearning, as well as offering a comprehensive suite of engagement tools for finance call centers

Thinking about gamifying your finance call center? Download your 2024 guide to gamification, and this buyer’s guide (which includes a free evaluation checklist)

For over a decade, Centrical has partnered with leading organizations across the globe to motivate and engage employees, boost performance, and build stronger frontline teams (and bottom lines). To learn more about how Centrical can benefit your organization, watch our platform in action with a quick preview, and request your personalized overview today.

Engage and motivate your frontline teams

Improve performance with an AI-powered digital coach

Deliver world class CX with dynamic, actionable quality evaluations

Boost performance with personalized, actionable goals

Nurture employee success with the power of AI

Listen and respond to your frontline, continuously

Drive productivity with performance-driven learning that sticks

Drive agent efficiency, deliver client results

Keep tech teams motivated and proficient on products and services while exceeding targets

Maintain compliance while building customer happiness and loyalty

Enlighten energy teams to boost engagement

Engage, develop, and retain your agents while driving better CX

Improve the employee experience for your reservations and service desk agents

Madeleine Freind

Madeleine Freind

Natalie Roth

Natalie Roth Linat Mart

Linat Mart

Doron Neumann

Doron Neumann Gal Rimon

Gal Rimon Daphne Saragosti

Daphne Saragosti Ella Davidson

Ella Davidson Ariel Herman

Ariel Herman Ronen Botzer

Ronen Botzer