From Promise to Payoff: Solving the Real Challenges Behind Collections KPIs

The current economic climate, marked by rising costs, consumer reliance on credit, and economic uncertainty, is leaving many consumers financially vulnerable. This growing fragility is fueling a resurgence in delinquencies and charge-offs, putting new pressure on collection agencies. At the same time, regulatory oversight remains complex and evolving, making compliance a moving target.

As a result, collections leaders face a perfect storm of rising account volumes, unpredictable recovery rates, and thinning margins. Meanwhile, their agents are burning out, leading to high attrition rates, while remote and hybrid work has introduced new challenges for onboarding, training, and performance management.

Hitting your KPIs has never been more difficult. But there is a path forward.

This guide explores the most critical KPIs for collections teams, not just by defining them, but by unpacking the reasons teams may fall short, and how performance enablement strategies powered by AI, personalized coaching, and real-time insights can change the game.

What Are the Most Common Debt Collection KPIs?

Debt collection organizations aim to maximize revenue and recovery rates by collecting the greatest amount of outstanding debt or receivables over a time period. This is critical for customer retention, as companies will measure the efficacy of agencies in their portfolio against one another. In this section, we will cover some of the most common key performance indicators (KPI) for debt collection.

| Collection KPI |

Definition |

| Right-Party Contact (RPC) |

The percentage of calls or contact attempts where the collector successfully reaches the person responsible for the debt, rather than wrong numbers, voicemail, or third parties. |

| Promise-to-Pay (PTP) |

The percentage of outbound calls by an agent that result in a promise to pay. The higher the rate, the better, as a PTP is an indicator of a successful call. |

| Cost per Contact |

This KPI indicates the cost of agent-consumer interactions, including calls, SMS, email, etc. |

| % of Total Collected (Total Recoveries Paid / Outstanding Debt) |

The ratio of debt collected from consumers to overall outstanding debt. |

| Total Collections per Agent |

A running number or a dollar goal that agents work toward collecting over a set period of time. |

| Average Payment Size |

This KPI reflects the average size of the payments made. This metric, when applied across agencies, can indicate which organizations negotiate higher payments for a shorter repayment time. |

| Productivity Rate |

This metric is measured by dividing the total recoveries paid by working hours. |

| Dials per Hour |

The average number of outbound calls an agent makes per hour. |

| Quality Assurance (QA) Score |

A high QA score indicates that agents are acting within regulatory compliance against measured processes. |

| # of SIFs (Settled in Full) and PIFs (Paid in Full) |

A SIF score indicates that an account is settled in full (for a lesser amount than owed) and then closed. PIF indicates that the owed amount is fully recovered. |

| Scheduled Adherence |

This metric demonstrates whether agents are adhering to their assigned schedules. |

Why Collections KPIs Are Tough to Hit and How Modern Collections Teams Are Solving It

Collections KPIs may seem straightforward on paper, but in practice, they’re anything but easy to achieve. Nearly every metric is influenced by factors that are often outside a team’s control: economic instability, regulatory complexity, and inconsistent consumer behavior. Additionally, a combination of internal and external factors influences collector burnout, which impacts the productivity, regulatory compliance, and success of frontline teams.

For modern collections leaders, the challenge is twofold: how to keep agents or collectors motivated and effective in a tough environment, and how to provide managers with the visibility and tools they need to support their team’s performance in real time.

That’s where performance experience software, powered by AI, comes in. Today’s leading debt collection agencies are closing performance gaps and improving KPI outcomes by:

- Embedding AI-powered coaching and microlearning directly into the collector’s daily workflow, not siloed in a separate LMS or limited to classroom training or scheduled coaching sessions.

- Leveraging real-time performance and engagement data to drive targeted coaching and proactive interventions.

- Using gamified goals, recognition, and team challenges to keep collectors focused, motivated, and accountable.

- Automating performance analysis and triggering next-best actions, so managers can focus on impact, not reporting.

A Strong Frontline Is the Key to Better Results

Here are a few strategies to future-proof your collections teams and help them thrive in the current environment.

🛫 Modernize Pre-Boarding and Onboarding

Engage new hires before Day 1 to reduce ghosting and lay the foundation for success. Personalized onboarding that includes KPI alignment, skill-based pacing, and gamified learning accelerates ramp time and reduces early attrition.

🐣 Nesting: The Transition Phase

Support new hires as they shift from training to live calls. Real-time feedback and AI coaching during the nesting phase help reinforce best practices and boost early confidence.

📚 Continuous Training

Learning doesn’t end after onboarding. With compliance standards, customer expectations, and internal processes always evolving, collectors need ongoing, personalized development. Microlearning embedded in the daily flow keeps skills sharp and aligned with business goals.

🪴 Coaching That Drives Performance

Effective coaching is proactive and personalized. AI-powered performance insights help managers identify emerging trends and intervene early, before small issues become bigger problems. Automated coaching prep and guided workflows ensure managers stay focused on impact.

🔑 Agent Empowerment

When collectors feel ownership over their performance and career path, they stay longer and perform better. Recognition, real-time feedback, development paths, and gamified goals turn daily work into an experience that feels purposeful.

🤝 Team Unity

High-performing teams are more than individuals: they operate with shared goals, mutual accountability, and a sense of belonging. Encouraging collaboration, celebrating collective wins, and fostering friendly competition can amplify performance across the board.

💬 Voice of the Employee

Collectors are on the frontline, and they know what’s working and what’s not. Actively capturing and responding to their feedback enables leaders to identify friction points, learn valuable insights, and make their employees feel heard and supported. Integrating VoE data with performance and engagement trends helps drive smarter decisions and demonstrates a commitment to continuous improvement and employee wellbeing.

The Role of AI in the Future of Debt Collections

The collections industry is at a turning point. The current challenges faced by collections teams require a new level of operational agility, and AI is making it possible.

Centrical’s Agentic AI transforms traditional performance enablement by turning data into intelligent, orchestrated action. Instead of manually sifting through dashboards or reports, team leaders and collectors now receive personalized, real-time support in the flow of work.

Agentic AI in Action

- AI Assistant for Managers: A multi-agent system that not only identifies gaps, but acts on them, recommending and automating coaching, training, and engagement workflows across connected systems.

- Personalized Success Plans: Automatically generated development journeys tailored to each agent’s KPIs, learning needs, and engagement signals.

- AI-Powered Quality & Coaching: Conversations are automatically evaluated, triggering performance scores, personalized learning, and coaching prompts to close gaps.

- Weekly Performance Summaries: GenAI-generated recaps and next-best actions keep collectors on track and managers aligned.

- Copilot for Operations Leaders: A conversational AI experience that unifies data analysis, forecasting, and performance planning, empowering leaders to act faster and smarter.

Centrical’s Impact on Collections Results

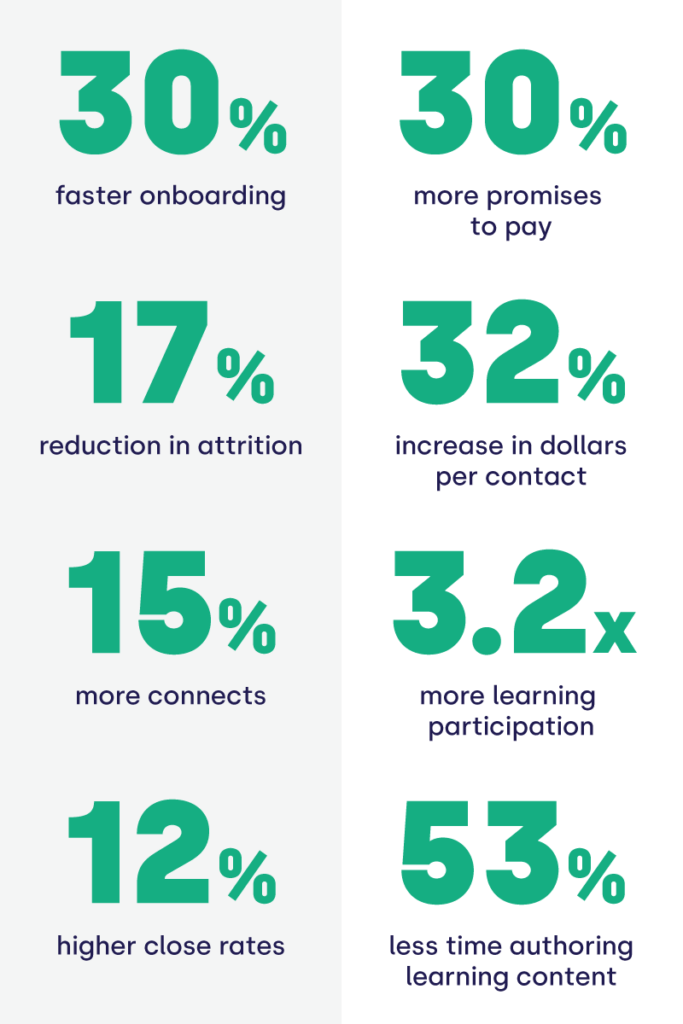

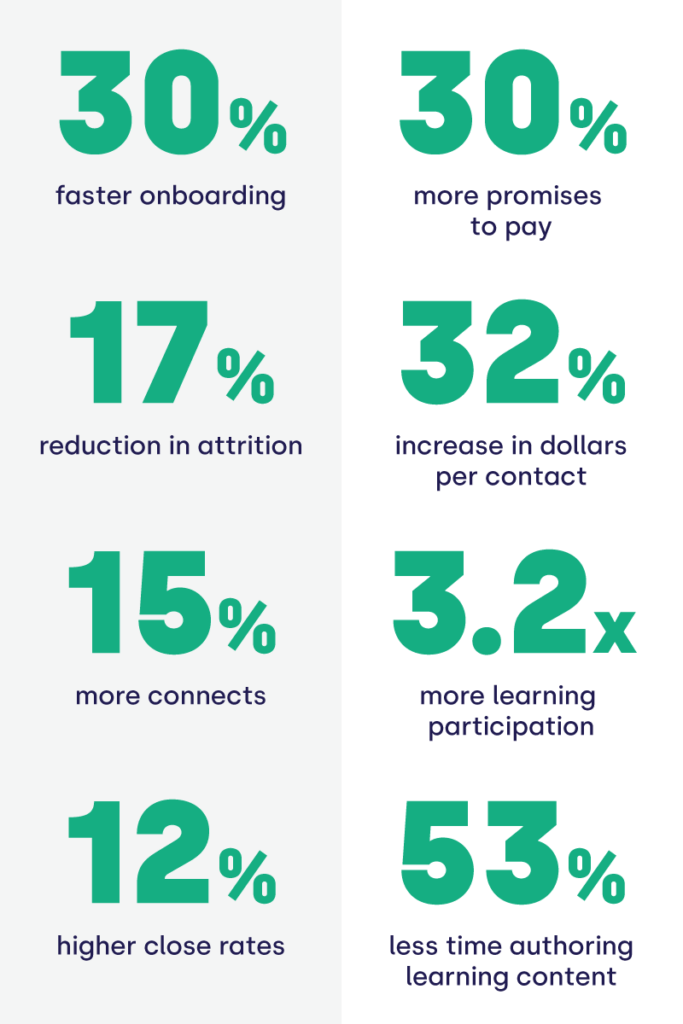

Centrical helps collections teams lift key KPIs like connect rates and PTP and reduce ramp up time and attrition, all without burning out your collectors. With our AI Performance Experience Platform, our clients have achieved the following results:

The Path Forward

With the right tools, the right data, and a people-first approach, your team can exceed its recovery targets and stay engaged doing it. Remember:

- KPIs are your compass. KPIs enable you to gather insights on efficiency and productivity and surface trends that might be affecting your team’s performance.

- Alignment matters. Align your collectors with their goals, as well as with each other.

- Turnover is preventable. Some turnover is inevitable, but you can prevent most of it by offering a supportive onboarding experience and investing in training, coaching, and opportunities for career advancement.

Engage and motivate your frontline teams

Improve performance with an AI-powered digital coach

Deliver world class CX with dynamic, actionable quality evaluations

Boost performance with personalized, actionable goals

Nurture employee success with the power of AI

Listen and respond to your frontline, continuously

Drive productivity with performance-driven learning that sticks

Drive agent efficiency, deliver client results

Keep tech teams motivated and proficient on products and services while exceeding targets

Maintain compliance while building customer happiness and loyalty

Enlighten energy teams to boost engagement

Engage, develop, and retain your agents while driving better CX

Improve the employee experience for your reservations and service desk agents

Madeleine Freind

Madeleine Freind

Natalie Roth

Natalie Roth Linat Mart

Linat Mart

Doron Neumann

Doron Neumann Gal Rimon

Gal Rimon Daphne Saragosti

Daphne Saragosti Ella Davidson

Ella Davidson Ariel Herman

Ariel Herman Ronen Botzer

Ronen Botzer